The Timid Bull Remains

What a week that was! Our OptionEasy Bootcamp was by some distance our best yet. The location was a tropical paradise and the whole thing from start to finish will forever be etched in all our memories.

A couple of important takeaways from the event …

One, that more people need to play with the tools in a coaching environment, which I’ll start doing in the coming weeks during our webinars.

Two, the new mobile optimized version of our tools is a massive time saver, not least for me as I was preparing this week’s review, but also for many of the delegates who used their smartphones for the exercises. Note, it’s still a web browser, not an app even though it does feel like one!

Three, make sure you never miss an alert, software update or market commentary join our free Telegram channel here.

Before my Market Outlook for the week ahead, just to remind you of an important update that we’re working on among others …

- Personalization is on its way. I’ll have updates for you shortly as to when you can save your settings for our charts so you always see them according to your preferences.

Market Outlook:

Our market commentary continues to be outstanding. Mastering market timing enables you to swim WITH the tide at the right time.

Over the last two weeks I’ve said there’s likely to be short term upside, while the medium term is uncertain.

Looking today, there’s enough ambiguity to go with the same theme again.

Watch the video for more detail.

Market Timers:

- Longer Term Market Timer (OVIsi):

Red. - Medium Term Swing Timer:

Bullish. - The Main Indices:

While the indices are up over the past few weeks, none of their OVIs look compelling right now.

Stock Selection:

This week I reviewed the newly improved Big Money Footprints Fast Filters which I rationalized a couple of weeks ago. I also focused on post-earnings, of which there are several decent setups, just in a slightly more challenging market.

Remember, our game is to play when the Big Money Footprints align neatly. By and large, they’re not right now – with a couple of exceptions, but the broad markets remain flaky right now.

The key to consistency is to pick your playbook and stick to the best quality setups that conform to it. If the setups aren’t there, keep your powder dry for another time.

My playbook is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are highly desirable but those four are essential to me! With my new VIP filters, I’m also now looking more at overbought and oversold issues.

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Don’t Miss Out:

Software Upgrades:

We’ve deployed some big updates recently, and many more game-changing upgrades will be made in time for the London Stocks Summit on December 6th.

Lined up for later this year:

- A.I. Interfaces:

If you like using A.I. applications, then you’re going to love a particular development we have in the pipeline for you, namely GPT inside our charting application! - More Automation:

This is likely to result in an overhaul of our Home Hedge Fund / OVIcopilot application, relating to Market Timing and even some stock selection.

- Journal Upgrade:

Phase 1 and 2 are both deployed, and there’s much much more to come in due course! - Personalization:

Soon you’ll be able to set your preferences for how your charts will be laid out each time you land on them. I’m personally very excited about that! - Options Enhancements:

Key improvements made to the Pricer and Analyzer, and more to be made soon. - Dynamic Earnings Calendar:

I showed this to the Options Bootcamp attendees and they want it now! - Updated ‘How To’ Video Guides.

We’ve already deployed a handy ‘How To’ click-through guide to help you navigate the platform. We’ll also be upgrading the Fast Filters still further.

More updates are on the way!

Upcoming Events:

Our Stocks VIP Summit in London is on the 6th of December! We’re going to upgrade this event, using the successes from Mayakoba as a blueprint.

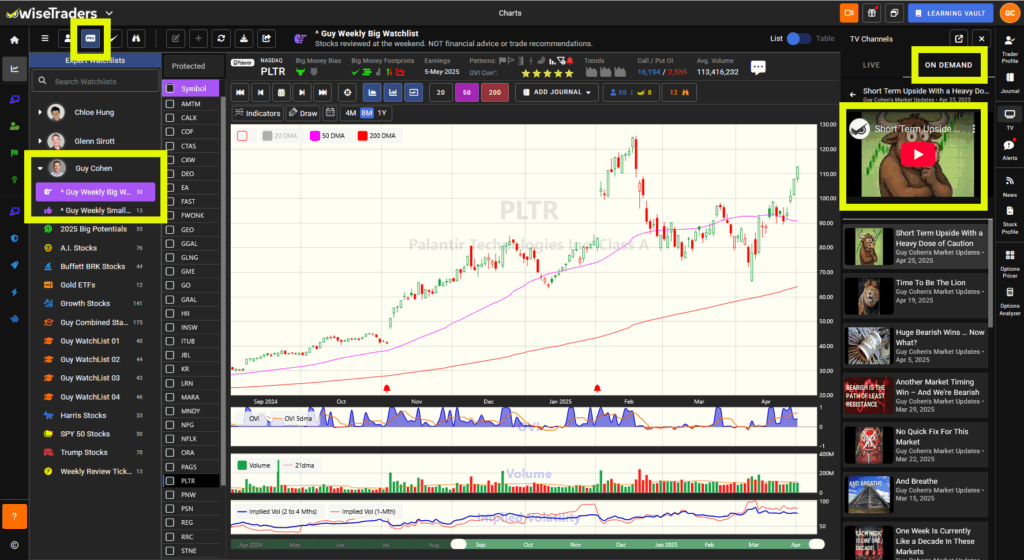

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://platform.wisetraders.com

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.