Some huge Platform and Learning Vault upgrades coming soon, so please keep your eye out.

Also please ensure you keep getting my reviews and communications by being in our Telegram channel here.

https://t.me/wisetradersovi

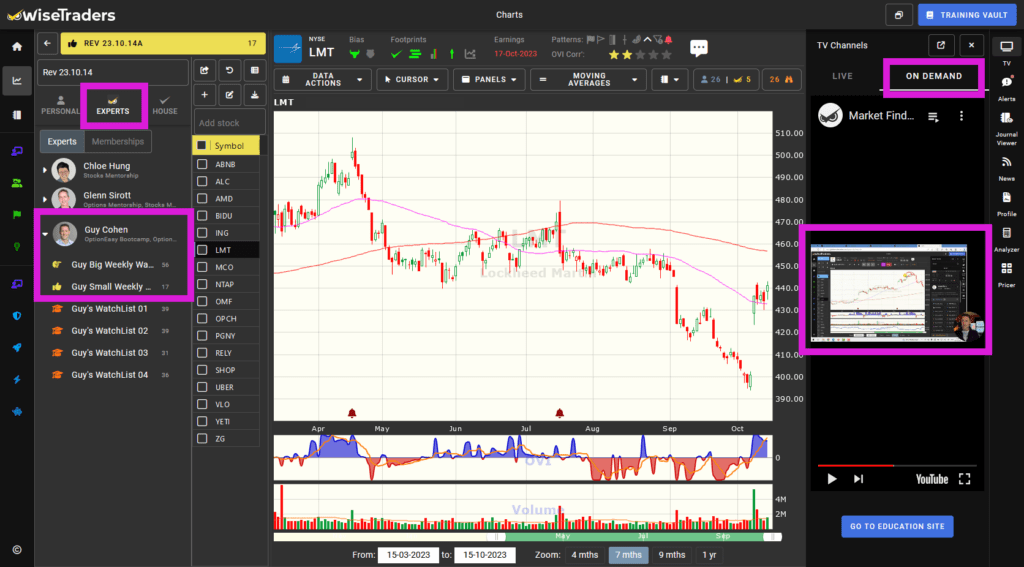

Today’s video is in a temporary location but you can still access it from inside the TV On Demand area of the Platform. See below for instructions.

The markets …

In the last few weeks I’ve mentioned that conditions haven’t quite been optimal.

Indeed, last week I said “Whatever happens from here it looks like it wants to be relatively untidy, which means you have to be extra vigilant and be doubly sure about what your game plan is “.

Sure, there have been some (not many) unambiguous Big Money Footprint setups, but you’ve had to earn your profits rather than them being handed on a plate for you.

This past week the S&P and Nasdaq have been propelled by the large caps, with six of the Big Seven up. This was signposted by last Friday’s bullish momentum bar.

Conversely the mid market (IWM) looks weak.

So, pick your battles, and stick to a well thought-out plan.

For Bootcamp attendees, we’ll soon be organising your Group Session with me, as soon as the new TradeFinder (inside the charts) is released … It’s looking very very good!

See below for Market Outlook.

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

Market Outlook:

Watch the video for more detail.

The SPY and QQQ are somewhat extended but still with upside potential. The IWM looks weak. I’m inclined to repeat last week’s words that the markets will continue to be inconsistent and ragged, while AI driven tech stocks remain flavour of the month. The SPY and QQQ are rather in hoc to the Big Seven, but that’s where comfort money seems to be attracted to right now.

Our market timing is a real strength that few others possess. Being good at market timing enables you to swim WITH the tide.

The Main Indices:

The SPY and QQQ could benefit from a pullback, both being extended from their 50-dma which is very extended from the 200-dma.

The DIA is just above its 50-dma with potention for upside, while the IWM is just below its 50-dma with potential for downside.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Bullish and not overbought. - Index OVIs:

Healthy blue for the SPY and QQQ. Just blue for the DIA and red for the IWM.

Fast Filters Stock Selection:

Again much out there of real AAA quality this week. If you think otherwise, then your analysis may not be tough enough!

Remember a chart needs to have the right qualities in order for you to consider trading it.

Pick your playbook and stick to the best quality setups that conform to it.

My playbook is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Software Upgrades:

A new chart design is almost complete where you’ll see real consistency between all the different charting applications. This will make things easier for you moving forward.

After that, journaling from the charts which will pave the way for:

- A link to a broker platform from the enhanced Journal app directly from the charts to make life much easier for you.

Imagine knowing if an options trade is in line with or violates your stated risk parameters!

We’ve already built the calculator engine, it just needs to be deployed. - More indicators to choose from inside our OVI charts …

Not so much for me personally, but I know many members do like to play!

Also, the full mobile phone (portrait) optimization is in the plan for the summer, and more dynamic notifications from inside the application will follow that. Lots to do!

Many more game-changing upgrades will be made in time for the London Stocks Summit on December 7th.

Events:

Our Stocks Summit in London on 7th December will be the most practical ever, with half of the event dedicated to practical exercises and with the most bonuses ever.

Like we just did in Orlando, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. Easily by the event, all your TradeFinder activities will be directly from the charts, saving you huge amounts of time.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.