Latest News

This is Where The Money is Made

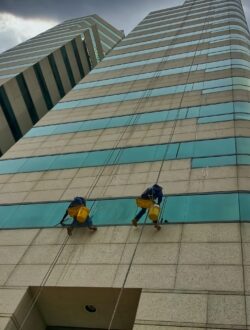

Time is flying … and there are just ten weeks until our transformational Options Bootcamp in Riviera Maya where you’ll be using our latest technology. Remember, if you’re attending online you will have a Q&A session directly with Chloe on the Sunday after lunch, where you can pick her brain as to how she’s achieved a near 80% win rate and 18X’d her account with very part time effort. Pure consistency. This is a golden opportunity to learn from someone who can teach and empathise with where you are. Make sure you’re there online – or in person – and be armed with your questions for Chloe directly. So, another weekend with big news dropping while the market are closed! Many people will be guessing and gambling, making impulsive trades, trying to guess how the market will react to the

Market reviews and blogs

Your best source of investment news from WiseTraders and Guy Cohen.

Robust But Fragile Market On Its Toes

Eleven weeks until our Options Bootcamp in Riviera Maya. This year I am unveiling new research and tools and tech

Friday 13th Could Have Been Scarier

This week saw wholly expected volatile behaviour in the last serious week of this bumpy earnings season. Friday’s action was

Jittery Markets Scrambling to Rotate

Greetings from Mayakoba, where I’m making a quick visit to help finalize preparations for our OptionEasy Bootcamp in May! It’s

Markets Just Hanging On

Hi Everyone MARKETS HANGING IN THERE …(apologies for those who experienced a data delay yesterday. I’m assured that was a one-off) Tuesday-Thursday witnessed something of a pullback and …

Down We Go … As Expected

Hi Everyone DOWN WE GO AS EXPECTED …

Yesterday we definitively moved down, with leading stocks such as AAPL turning down as expected.

QQQThe QQQ broke below its support of $58 an…

Easy as 10-minutes per day

Hi EveryoneYOU CAN MAKE THIS VERY EASY – STICK TO THE OVI AND SUPPORT/RESISTANCE BREAKOUTSWhen you see the charts in this eLetter you’re going to like how easy our trading method is.Remember, we trad…

Don’t Force It …

Hi Everyone

The markets are wobbly right now and it could be a case of “Sell in May and Go Away”. The key to your trading success is don’t force a trade when it’s simply not there…

No Breakout No Losses

Hi Everyone Commodities and commodity stocks have continued to slide, especially Silver after its parabolic run, and the main indices are consolidating. Many stocks forming Bull Flags have rolle…

OVI Market Update

Some wobbles in the markets over the last couple of days with Silver in particular taking a pounding, Gold and Oil looking vulnerable too. World events don’t seem to have had much effect as we look …

OVI Update

Well, this earnings season has something for everyone as the indices grind upwards but some leading stocks have been hammered, some have whipsawed, and others have missed targets and yet still hav…

OVI Update

A quick update on yesteday’s post. The tech sector has sent the markets soaring. This, mixed with Standard & Poors downgrading “Uncle Sam” has also led to Gold and Silver continuing …

Informed Trader eLetter – OVI Report

Hi Everyone

Mixed news is the how this earnings will be remembered. Some stocks have been flying and others have been hammered! Let’s start with the main indices: SPY (S&P…

In the thick of Earnings Season – see AAPL

So last week we had GOOG causing shockwaves. This week it could be AAPL’s turn on the 20th. Now this is one I have mixed feelings about … here’s why: You’d be a brave soul to eve…