Latest News

This is Where The Money is Made

Time is flying … and there are just ten weeks until our transformational Options Bootcamp in Riviera Maya where you’ll be using our latest technology. Remember, if you’re attending online you will have a Q&A session directly with Chloe on the Sunday after lunch, where you can pick her brain as to how she’s achieved a near 80% win rate and 18X’d her account with very part time effort. Pure consistency. This is a golden opportunity to learn from someone who can teach and empathise with where you are. Make sure you’re there online – or in person – and be armed with your questions for Chloe directly. So, another weekend with big news dropping while the market are closed! Many people will be guessing and gambling, making impulsive trades, trying to guess how the market will react to the

Market reviews and blogs

Your best source of investment news from WiseTraders and Guy Cohen.

Robust But Fragile Market On Its Toes

Eleven weeks until our Options Bootcamp in Riviera Maya. This year I am unveiling new research and tools and tech

Friday 13th Could Have Been Scarier

This week saw wholly expected volatile behaviour in the last serious week of this bumpy earnings season. Friday’s action was

Jittery Markets Scrambling to Rotate

Greetings from Mayakoba, where I’m making a quick visit to help finalize preparations for our OptionEasy Bootcamp in May! It’s

OVI Charts – QQQQ is now QQQ

A quick note to alert you that the QQQQ has gone back to its original symbol of QQQ. Normally that wouldn’t be an issue, but the new symbol needs to be annexed to the old symbol within our OVI c…

No Surprises Whatsoever

Hi Everyone.

As horrific as the events in Japan have been, make no mistake, the markets were going to fall anyway.

The OVI on the S&P and Nasdaq has been pointing the way for almost …

OVI Market Update 10 March 2011

Hi Everyone

No surprises with the market action today – the OVI has been pointing the way for a while now, and the charts have been wobbly too.

Before I give more details, please do folllow me o…

Latest Update from Guy

Just a quick message to give you an update on progress.

The Markets First, just to say the markets are looking increasingly sloppy and the OVI is bumbling just under zero on the S&…

The Power of the OVI …

In this short video I explain how the OVI works so well, how it worked a treat on two stocks this weekend, and how you can use it moving forward.

[usercontrol: /User controls/CamtasiaPlayer.ascx…

OVI Market Update 16 November 2010

Hi Everyone

The markets have been due a well needed rest and are taking a good smack right now.

While I’m very concerned about the repeated need for Quantitative Easing and its long term effect…

Quantitative Easing Defined

Hi Everyone

The markets started to wobble as the S&P got dizzy from breaking its year highs. I’m thinking that this will be the start of some further wobbles as the market makes up its…

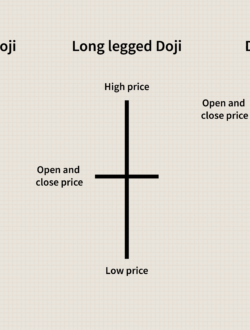

Doji City

Hi Everyone

Over the weekend I said the markets were likely to rise today and luckily for me they obliged.

However, the Nasdaq and S&P are both displaying Doji bars today after breaking int…

OVI Market Update

OVI Market Action:

Like it or not, logical or not, the markets are poised to break one way or another. Bull flags still have the edge, but there are some beautiful looking bear flags out there too, a…

Stop Limits, The Markets

Market Action:

I don’t like today’s action which looks very dojo-like on the S&P and Dow which both broke to new highs only to come back into their consolidations – not the decisive type of …