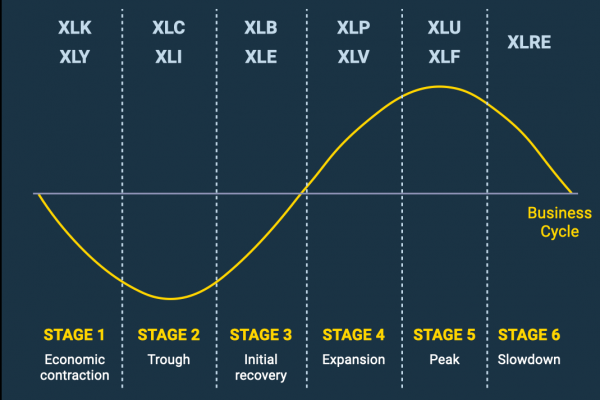

Business Cycle And Sector Rotation In Action

In this blog post, you will learn what stage of the business cycle the stock market is currently in and how traders can profit from sector rotation.

The business cycle is one the many factors that contribute to sector rotation. Did you know that we have been in the midst of an economic contraction (Stage 1) since early 2019?

Tech (XLK) has enjoyed a significant run up from 2019 to 2021 thanks to the drop in interest rates. Hence, when the Federal Reserve (FED) slashed interest rates to near zero in 2021, as a response to the Covid-19, the economy showed signs of entering a trough (Stage 2). Money has started to flow out of tech (XLK) since then.

Sectors that will benefit the most from the economy’s reopening, such as consumer discretionary (XLY) and industrials (XLI) have started to exhibit signs of big money activity. The effects of this sector rotation may not be obvious to traders who were unaware of this shift in big money within the various sectors.

As 2022 began, we’ve been hit with reports of rising inflation, interest rates, and escalating tensions between Russia and Ukraine. This has contributed to the fall in tech (XLK) and the rise in energy (XLE). Countries all over the world are also preparing to reopen their borders after a two-year closure due to covid. These economic factors are hints that we might currently be in the initial recovery stage (Stage 3).

Before we dive into the various stages of the business cycle, let’s take a closer look at how sector rotation works.

The Basics of Sector Rotation

What is Sector Rotation?

Sector rotation is the flow of money from one stock market sector into another. It occurs when institutions or big money managers sell stocks in one sector and use the proceeds to invest in another sector.

The Logic Behind Sector Rotation

Institutions and big money managers will rotate in and out of various sectors. This allows them to take advantage of changes in economic growth. Some sectors tend to be more sensitive to economic changes than others. Therefore, rotating money in or out of stocks within those sectors can result in higher returns.

The Relationship between the Business Cycle and Sector Rotation

The stock market typically moves 6-9 months ahead of the economy. That means it usually moves in anticipation of where the overall economy will go in the future. Hence, markets will anticipate and price in any news that will result in a shift in the business cycle before the event actually occurs.

Different sectors tend to perform differently based on the six stages in the business cycle.

Six Stages of the Business Cycle

Stage 1: Economic Contraction

- The economy is contracting as a result of a drop in consumer spending.

- The unemployment rate is rising, while business sales and earnings are declining.

- This will encourage the FED to lower interest rates, as they did in 2019.

Stock Market Implications

- Because the stock market moves ahead of the economy, it will expect the economy to bottom out at this point. Institutions and large money managers will look to invest in high-growth industries such as technology.

- Non-essential goods and services will see increased investment interest as consumers begin to spend on them once they have enough money.

- In theory, we expect tech (XLK) to be the first to rise, followed by consumer discretionary (XLY). Stocks from these two sectors typically lead the bull run in the stock market. This is what we’ve seen happen from 2019 – 2021.

Stage 2: Trough

- The economy is bottoming.

- Interest rates, consumer spending, the cost of goods and services, business sales, and earnings are all at all-time lows, while unemployment is at an all-time high.

- The economy appeared to be bottoming out when the Federal Reserve slashed interest rates to near zero in response to the pandemic in 2020.

Stock Market Implications

- At this point, the stock market anticipates an economic recovery, and more money will flow into consumer discretionary (XLY), which stands to benefit the most if consumer spending increases.

- Industrials (XLI) will also begin to rise as construction, transportation, and manufacturing activities pick up.

- When compared to more cyclical sectors such as industrials and consumer discretionary, the communications (XLC) sector is relatively more stable. Stocks in this sector are a good hedging instrument for an investor’s portfolio, especially if it is heavily weighted in technology and cyclical sectors.

Stage 3 and 4: Initial Recovery and Expansion

- The economy moves from a trough to a peak.

- Interest rates, consumer spending, the cost of goods and services, business sales, and earnings all begin to rise as unemployment falls.

- There are signs that we are currently in the early stages of recovery (Stage 3), as economies begin to reopen and the FED begins to hike interest rates.

Stock Market Implications

- Basic materials (XLB) and energy (XLE) tend to outperform during the initial recovery stage as they benefit from a rise in commodity prices and increased demand from an expanding economy.

- We are currently seeing this type of behavior in the markets the where the XLE is outperforming all the other sectors due to escalating tensions between Russia and Ukraine.

- The continuous rise in commodity prices will eventually lead to inflation, which hurts the economy. When inflation becomes too high, consumers will start to cut back on their spending.

- As the market becomes overextended and approaches its peak, the stock market will anticipate an impending recession.

- Indication of a market peak occurs when money begins to flow into consumer staples (XLP) and healthcare (XLV). These are recession-proof sectors because they include goods and services that are a necessity to consumers such as medicine, groceries, household, and personal care products.

- Investors and traders should watch for signs of big money activity within these four sectors: XLB, XLE. XLP, XLV. This will give you an indication when the market is reaching its peak (Stage 4).

- At WiseTraders, we use the OVI indicator to determine where the big money flow is. The indicator has been telling us that big money has been flowing into the XLE since the end of 2020. That means institutions have been expecting the economy to move into Stage 3 (initial recovery) as early as Q1 of 2021.

Stage 5: Peak

- Economic growth begins to slow as it reaches a peak. Rising interest rates and commodity prices are beginning to hurt the economy.

- This will encourage the Federal Reserve to slash interest rates.

Stock Market Implications

- As it reaches its peak, the stock market is already anticipating a recession. This causes money to flow into the utilities (XLU) and financial (XLF) sectors.

- Utilities stocks generate stable dividend income over the long term, which is a great alternative for institutions and big-money managers as the FED begins to slash interest rates.

- Financials also stand to benefit when interest rates drop as the cost of borrowing will decrease. This encourages lending and results in increased revenue from loans and mortgages to financial institutions.

Stage 6: Slowdown

- The economy begins to contract.

- This eventually leads to a market bottom, and the cycle repeats itself.

Stock Market Implications

- The stock market is pricing in an economic contraction at this stage.

- Real estate (XLRE) will gain traction before the shift back to high-growth sectors begins again when the markets make their bull run.

From a theoretical standpoint, there are many economic factors to consider when trading sector rotation. While economic theories help traders in understanding the overall nature of the stock market, the stock market may not necessarily move according to these theories.

Following in the footprints of institutions and large money managers is a much simpler approach to trading. This approach is covered in this blog by WiseTraders’ Head Mentor Glenn Sirott.