Please ensure you keep getting my reviews and communications by being in our Telegram channel here.

https://t.me/wisetradersovi

Back home now and the return trip was remarkably unscathed by the Crowdstrike/Microsoft meltdown.

Again, I’m hugely appreciative of how our Platform upgrades have enabled me to whizz through the markets so much faster. It’s truly a game-changer and we have more in store for you over the coming weeks.

The markets …

Ok, so I’ve now mentioned for about a month how market conditions have been ‘sub-optimal’.

And while there have still been opportunities to nibble at P1 targets, these kinds of conditions will often ‘pop’ due to some unforeseen catalyst. In this case the Crowdstrike/Microsoft meltdown.

In our private group chats one veteran trader mentioned the challenge of being a lion (as opposed to a headless chicken). But this is very much part of our playbook.

Also, take Chloe’s example – remember she’s a 17x account trader, so it’s worth listening to her!

Chloe pauses if she makes three consecutive losses. Yes, that happens even to her! And she’s 17x’d her account … And I should add, without taking P2s and without compounding her winnings. If she had, she’d be at about 100x.

So, please take this guidance to be cautious when the markets aren’t quite right.

In recent weeks that’s included overbought indices, whippy market conditions, false breakouts, etc.

At the same time, stay true to the method and you’ll find some absolute peaches … even like the DIA mentioned two weeks ago. A rise of 4% from a plum Big Money Footprints setup returned 40% from conservative deep ITM calls expiring in January!

You don’t need many of those – with solid stocks/ETFs to make a real difference.

And while each each I’ll go through many setups with you, much of that is to help train your eye and give you the practice of seeing these wonderful Big Money Footprints unfold.

So, commit to being the lion! Don’t become a headless chicken just because you missed a setup. Plenty will come. You can – and must – be patient.

See below for Market Outlook.

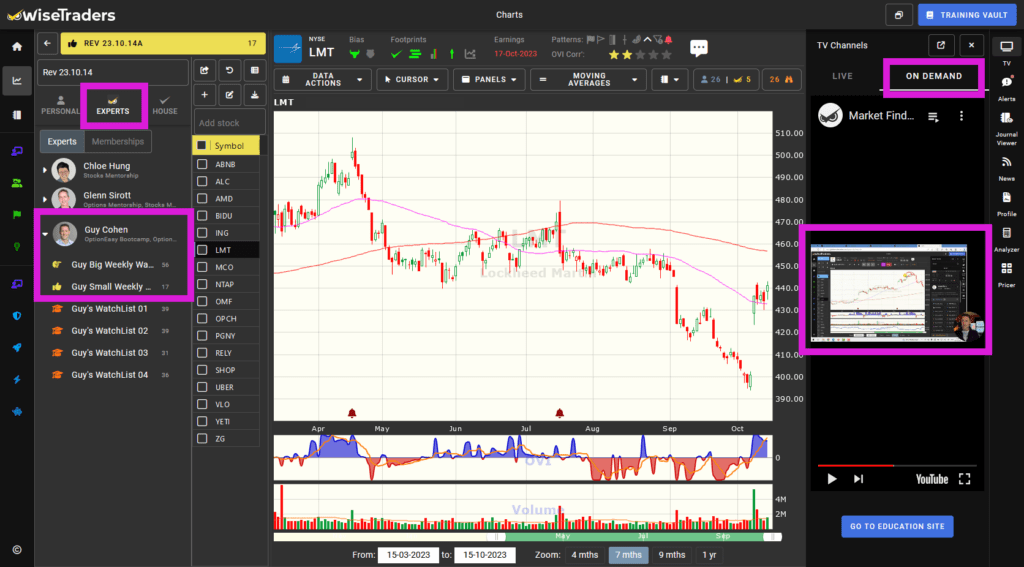

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://members.wisetraders.com

- Click on Platform (top right)

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

Market Outlook:

Watch the video for more detail.

What’s interesting about the Crowdstrike outage on Friday is that the markets were already retreating from overbought levels in the preceding days.

I’ve mentioned likely sector rotation over the past few weeks and that seems to be another interesting call, which is likely to continue. The market’s addiction to the tech megacaps is likely to be tempered in the medium term as Friday’s incident showed systemic vulnerabilities that will need to be addressed in two ways:

- More robust protocols – which cost money

- More regulation and potentially a friendlier environment for more competition.

Make no mistake, there will be a postmortem on this event, and if the world has got its hat on straight, significant protective measures will have to happen. You cannot be apathetic about large exposures to systemic failures that can affect international trade/travel/defence/healthcare/education, etc.

So, the market/sector rotation that I have mentioned for a while, is likely to continue.

Also, I mentioned last week that earnings – while likely to have a positive bias – would be a mixed bag. Certainly the latter is looking correct. There’s still a while to go for the rest of this earnings cycle.

Finally, as I’ve mentioned over and over again during the last few weeks, quality has been in short supply, giving us fewer setups to focus on.

Our market timing is a real strength that few others possess. Being good at market timing enables you to swim WITH the tide.

The Main Indices:

Last week I said this, verbatim:

“We now have a peculiar situation where all the main indices could be considered overbought! … Ultimately tricky conditions prevail, so be cautious and fussy … particularly with so much news being released in the coming weeks. Be ready with the big guns for when there are friendlier conditions.”

That sounds quite prescient doesn’t it!

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Bullish but pointing downward. - Index OVIs:

QQQ OVI is red. The other main indices’ OVIs haven’t capitulated.

Fast Filters Stock Selection:

How cool are these most recent upgrades, saving us so much time to do our analysis!

On Thursday we’ll have a webinar where I’ll go through all my shortcuts and time-saving hacks that the new Platform enables us to enjoy, so please look out for that webinar invitation.

Remember, quality beats quantity. Even with our amazing new technology, a chart still needs to have the right qualities in order for you to consider trading it.

Pick your playbook and stick to the best quality setups that conform to it.

My playbook is OVI, near Key Levels, Shrinking Retracements, and a consolidation/sideways move. The other two Big Money Footprints are desirable but those four are essential to ME!

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Software Upgrades:

Soon we’ll deploy the updated ‘How To’ video guides, and there’ll also be a handy ‘How To’ clickthrough guide to help you navigate the platform.

Next up is the journaling from the charts which will pave the way for:

- A link to a broker platform from the enhanced Journal app directly from the charts to make life much easier for you.

Imagine knowing if an options trade is in line with or violates your stated risk parameters!

We’ve already built the calculator engine, it just needs to be deployed. - More indicators to choose from inside our OVI charts …

Not so much for me personally, but I know many members do like to play!

Also, the full mobile phone (portrait) optimization is in the plan for the summer, and more dynamic notifications from inside the application will follow that. Lots to do!

Many more game-changing upgrades will be made in time for the London Stocks Summit on December 7th.

Events:

Our Stocks Summit in London on 7th December will be the most practical ever, with half of the event dedicated to practical exercises and with the most bonuses ever.

Like we just did in Orlando, each session will have a practical exercise for you to complete, so you can build your confidence in finding the exact type of setup you want to focus on. Easily by the event, all your TradeFinder activities will be directly from the charts, saving you huge amounts of time.

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.