Last week’s “Dry Powder” call was inspired, and I’m going to repeat it for this week.

In fact I’m going to go further and suggest this market has a big chance of a significant pullback – correction if you will – in the coming months.

Last week was messy, and this earnings season hasn’t yet delivered. It still has a chance to redeem itself, and there are stocks that have gapped up, but it’s aftermath that I’m setting my sights on.

Remember, it’s quality that we’re looking for. The best quality setups. Mediocre is not good enough.

Silver took the headlines by dropping over 30% in just a couple of days. I warned of not chasing it. Same as Gold which at one point had dropped 15%.

This week I was asked to share my routines – so if you get a chance please watch the webinar I gave on Friday, where I reviewed my “Quick Routine”, which anyone can do in just a few minutes.

Also, do make use of our amazing Earnings Calendar application, and get involved in our Telegram groups. Soon we’ll put those groups inside the Platform to make them more interactive, and I’ll keep providing further insights for you in that format.

If you missed out on 15-minute refresher session with one of my team in the last couple of weeks, grab a spot here.

And just a reminder of our Options Bootcamp in Mayakoba, Riviera Maya, Mexico on 9-10 May. I’ll be broadcasting from there next week as I scope out the venue!

When it comes to responsible options, no one does it better than us or our tools, so if that sounds interesting, have a chat with us here.

Market Outlook:

Last week I referred to the peculiar start this earnings season has made, and that continues.

While there’s still a chance for it to redeem itself, I’m beginning to look beyond this earnings, and I see increasing chances of a meaningful correction. 10% for sure, and possibly up to 20%, which would take the SPY under 600 and lower. Now is not the time to speculate on that as we’ll want to see confirmation that a correction is in process, but the past few months of outsized bearish monorail bars are one clue of informed selling activity.

Again, as per last week, it’s pretty clear that conditions are going to continue being bumpy, so my guidance continues for you to be super fussy, only go for post-earnings setups and don’t let profits slip away … Protect them early. Or stick to dry powder.

Our market commentary continues to be outstanding. Mastering market timing enables you to swim WITH the tide at the right time.

Watch the video for more detail.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Bearish, just. - The Main Indices:

The QQQ’s OVI is blue, while the others are neutral.

Stock Selection:

Even with the shaky earnings so far, I’m loving using the new Earnings Calendar. It’s a wonderful tool for getting a feel for the earnings environment and finding trades.

This week my focus is again to ensure I avoid stocks with imminent earnings. Again, the Big Money Footprints I focus on most are OVI, Trend Fade and Key Levels.

** Remember, managing risk in your trade management is as important as trading with higher probabilities. This is very much part of the WiseTraders method, and is our third Master Key. **

Look in our Gift area inside the Platform to watch “How to Cap Your Losses & Protect Your Profits“.

Increasing your probabilities with a logical proven system is an essential part of trading. But you also need a rock solid trade plan that tilts the odds further in your favour.

Our EDGE Trade Plan does exactly that, and you will find trading so much more rewarding and peaceful if you adhere to its principles.

My goto playbook is OVI, near Key Levels, Trend Fades, and a consolidation/sideways move. The other two Big Money Footprints are highly desirable but those four are essential to me! With my new VIP filters, I’m also now looking more at overbought and oversold issues.

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Don’t Miss Out:

Software Upgrades:

More game-changing upgrades will be made in time for the Mayakoba Options Bootcamp on 9-10 May.

Lined up for later this year:

- Market Timing:

A significant upgrade to our Market Timing and Dashboard area is in the works. Stay tuned for any announcements.

- A.I. Interfaces:

If you like using A.I. applications, then you’re going to love a particular development we have in the pipeline for you, namely GPT inside our charting application! - More Automation:

This is likely to result in an overhaul of our Home Hedge Fund / OVIcopilot application, relating to Market Timing and even some stock selection.

- Options Enhancements:

Key improvements have already been made to the Pricer and Analyzer, and more to be made soon. - Dynamic Earnings Calendar:

First release made and more improvements to follow.

More updates are on the way!

Upcoming Events:

Our Options Bootcamp in Mayakoba, Riviera May, Mexico is on May 9-10th! It’s going to be super practical, using all the new enhancements to be released especially for the event. Don’t think you can do options? I’ll prove you wrong!

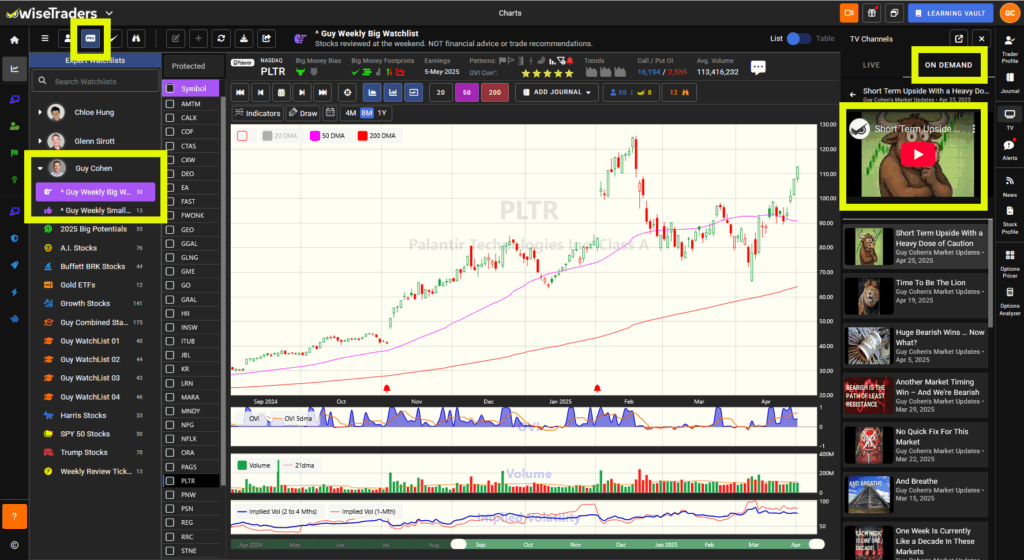

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://platform.wisetraders.com

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.