Eleven weeks until our Options Bootcamp in Riviera Maya. This year I am unveiling new research and tools and tech that change the game by optimising the universe of stocks and enabling a single click to analyze the options strategy. There’s nothing like it anywhere, and half of the event is dedicated to practicals and finding the optimal setups.

So … how can a market be robust but fragile?!

Like this …

On the one hand the indices simply aren’t budging down, but they keep threatening to!

Much of tech has taken a beating, but sector rotation has enabled the indices to stay near their highs.

My own take is that the large sell-off bars are likely to be Big Money distribution followed by retail take-up. Sooner or later there won’t be the retail take-up and the indices will pull back meaningfully.

However, you cannot act on it until we get a clear signal, and that simply hasn’t happened yet. More in the Market Outlook section below.

If you’re attending our Bootcamp remotely from home, Chloe will be giving a dedicated Q&A session on the Sunday after lunch.

Pick her brain! She’s been in your shoes. She’s 18X’d her account very much part time. Ask her directly. We’ll be collecting questions in advance.

Learning from someone who’s been there and done that is one of the most effective ways to crack the code. It’s worth remembering, unlike so many others out there with seemingly excellent results, Chloe excels in her win ratio of almost 80% over c. 170 trades. That means no homeruns that have distorted her numbers. Pure consistency. This is a golden opportunity to learn from someone who can teach and empathise with where you are. Make sure you’re there online – or in person – and be armed with your questions for Chloe directly. One spoiler … Her superpower is laser like focus. Walk in her shoes and be inspired by her ongoing experience.

When it comes to responsible options, no one does it better than us or our tools, so if that sounds interesting, have a chat with us here.

Market Outlook:

My medium-term outlook remains that the indices will pull back at least 10% from the highs, and likely more in the coming months.

However, you cannot ignore what’s before your eyes, and as of Friday’s close the indices are still refusing to budge.

So, regardless of tariffs and interest rate drama, the market put in a good show on Friday, and – if there were no new big news – the indices would be likely to inch up next week.

However, geopolitical events make everything a little fragile right now. And as I write this on Saturday afternoon, the latest news is that President Trump has announced tariffs of 15% after the Supreme Court’s striking down of his sweeping import taxes.

Where does that leave things?! Well, in a market where one day is like one month, who’s to speculate. Dry powder sounds like a good idea and let’s see where the dust settles!

Our market commentary continues to be outstanding. Mastering market timing enables you to swim WITH the tide at the right time.

Watch the video for more detail.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Neutral, emerging from bearish. - The Main Indices OVIs:

SPY and DIA neutral. QQQ negative. IWM positive.

Stock Selection:

Another week where I had to work to earn my corn in terms of finding decent setups. There are a couple that fit my criteria for Big Money Footprints AND risk control.

Mainly, powder is dry however, and as I mentioned last week, this is what sets apart really great performance. Be patient. Optimal setups will return soon enough, and when they do they can keep you fed for months. A bit like how a lion feasts!

** Remember, managing risk in your trade management is as important as trading with higher probabilities. This is very much part of the WiseTraders method, and is our third Master Key. **

Look in our Gift area inside the Platform to watch “How to Cap Your Losses & Protect Your Profits“.

Increasing your probabilities with a logical proven system is an essential part of trading. But you also need a rock solid trade plan that tilts the odds further in your favour.

Our EDGE Trade Plan does exactly that, and you will find trading so much more rewarding and peaceful if you adhere to its principles.

My goto playbook is OVI, near Key Levels, Trend Fades, and a consolidation/sideways move. The other two Big Money Footprints are highly desirable but those four are essential to me! With my new VIP filters, I’m also now looking more at overbought and oversold issues.

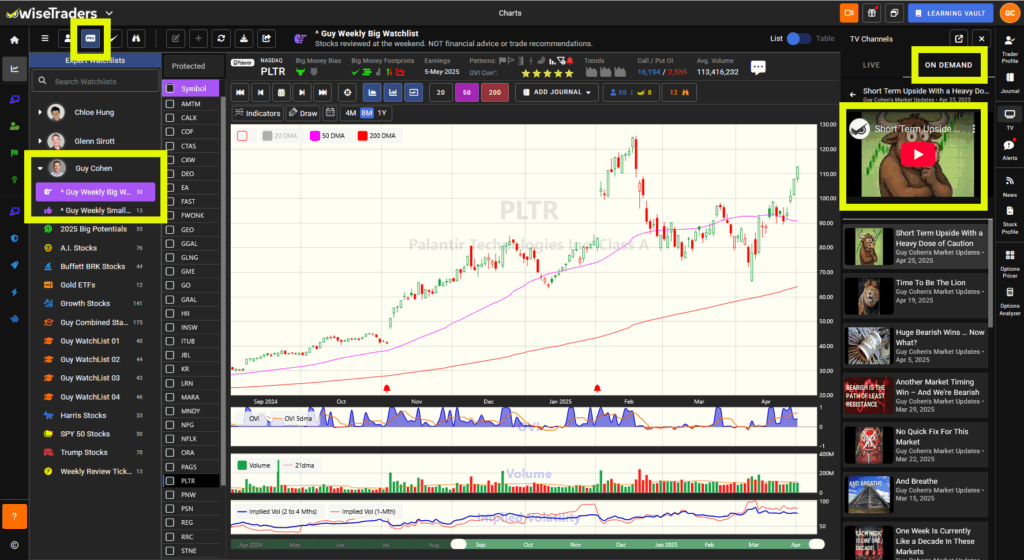

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Don’t Miss Out:

Software Upgrades:

More game-changing upgrades will be made in time for the Mayakoba Options Bootcamp on 9-10 May.

Lined up for later this year:

- Instant Chart Data:

Click on a stock and the chart loads without blinking. That’ll save me hours of time each week.

- Market Timing:

A significant upgrade to our Market Timing and Dashboard area is in the works. Stay tuned for any announcements.

- OVI Upgrades:

Two huge upgrades are coming for the OVI!

First is a mechanism to increase the number of stocks and ETFs to be more readable.

Second is a new research project that dramatically reduces our universe (so saving time) while increasing the probability of a profitable move.

Both of these are game-changers.

- Options Enhancements:

The Analyzer upgrade is almost ready. It will demonstrate anyone’s ability to trade options with complete visibility in just a click.

- More Automation:

All these enhancements are paving the way to more automation, and accelerated use of A.I. while avoiding the pitfalls of overfitting.

The result will be more precision and less time.

More updates are on the way!

Upcoming Events:

Our Options Bootcamp in Mayakoba, Riviera May, Mexico is on May 9-10th! It’s going to be super practical, using all the new enhancements to be released especially for the event. Don’t think you can do options? I’ll prove you wrong!

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://platform.wisetraders.com

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.