There are just 3 weeks to go until our Stocks VIP Summit on 6th December.

This is the event that has been life-changing for many members who attend remotely, in-person, or even after via the recordings.

It’s a practical day where you’ll use the platform, search for optimal trades in just a couple of clicks.

You’ll get a glimpse of the near future with the new technology and research we’re deploying to give you more precision, efficiency and enjoyment.

Be part of this exclusive and very special occasion.

Back to the markets, by now you should have felt the volatile nature of this particular phase.

In just the past five days we gapped up then back down … All in line with our commentary for the past couple of months.

In today’s Market Review you’ll see a lot of educational charts so you’ll be fully prepared for the next phase of the market.

Market Outlook:

Last week I mentioned that “volatility and steep pullbacks will continue to be part of this market, so be super picky and protect your profits early and fast“.

That’s a pretty decent summary of what’s happened, and it’s similar for this upcoming week too. The main difference being that there is an increasing number of bearish setups that look good now, and I expect more wobbles in both directions.

The delayed disclosures of Michael Burry’s short AI positions spooked the markets, only to be further complicated by the winding up of his fund.

Does that mean he’s admitting defeat?

I doubt that!

More that he probably feels it’ll be a choppy ride (down) and he’s wealthy (and patient) enough to ride it out with his own family office funds without the pressure of managing external client funds.

Remember, he called the real estate / banking collapse well over a year in advance, during which time his short positions experienced serious discomfort.

Our time horizon tends to be shorter than that, so we’re not looking that far ahead. But the fact remains the markets are skittish at this time, and skittishness is not optimal for the swing trader’s time horizon.

The good news is that it passes quite rapidly, and we have to be aware and alert because things can change quickly, and we want to be ready for the decisive next move.

Our market commentary continues to be outstanding. Mastering market timing enables you to swim WITH the tide at the right time.

Watch the video for more detail.

Market Timers:

- Longer Term Market Timer (OVIsi):

Green. - Medium Term Swing Timer:

Bearish. - The Main Indices:

Negative or neutral for all the main four indices.

Stock Selection:

This week was one of the more challenging weeks to find gems. That’s fine – it’s a natural phenomenon.

My main focus has been post-earnings … there are a few out there in both directions, but I’m not anticipating major moves that are smooth.

It’s choppy out there, and a good time to hone your technique in preparation for the next productive phase in the market.

** Remember, managing risk in your trade management is as important as trading with higher probabilities. This is very much part of the WiseTraders method, and is our third Master Key. **

Look in our Gift area inside the Platform to watch “How to Cap Your Losses & Protect Your Profits“.

Increasing your probabilities with a logical proven system is an essential part of trading. But you also need a rock solid trade plan that tilts the odds further in your favour.

Our EDGE Trade Plan does exactly that, and you will find trading so much more rewarding and peaceful if you adhere to its principles.

My goto playbook is OVI, near Key Levels, Trend Fades, and a consolidation/sideways move. The other two Big Money Footprints are highly desirable but those four are essential to me! With my new VIP filters, I’m also now looking more at overbought and oversold issues.

Go into the ‘Expert Watchlists’ area of the platform to view my Watchlists for (a) all the stocks I cover in today’s video, and (b) a smaller list that warrant a closer look.

** The list of stocks is in the Expert Watchlists area (just click on my image to see them), so you’ll have to log in to see it. Market Timing will also go inside a login soon. Remember to reference the video commentary so you know what my sentiment is on each stock listed. **

Don’t Miss Out:

Software Upgrades:

More game-changing upgrades will be made in time for the London Stocks Summit on December 6th.

Lined up for later this year:

- Market Timing:

A significant upgrade to our Market Timing and Dashboard area is in the works. Stay tuned for any announcements.

- A.I. Interfaces:

If you like using A.I. applications, then you’re going to love a particular development we have in the pipeline for you, namely GPT inside our charting application! - More Automation:

This is likely to result in an overhaul of our Home Hedge Fund / OVIcopilot application, relating to Market Timing and even some stock selection.

- Options Enhancements:

Key improvements have already been made to the Pricer and Analyzer, and more to be made soon. - Dynamic Earnings Calendar:

First release made and more improvements to follow.

More updates are on the way!

Upcoming Events:

Our Stocks VIP Summit in London is on the 6th of December! We’re going to upgrade this event, using the successes from Mayakoba as a blueprint.

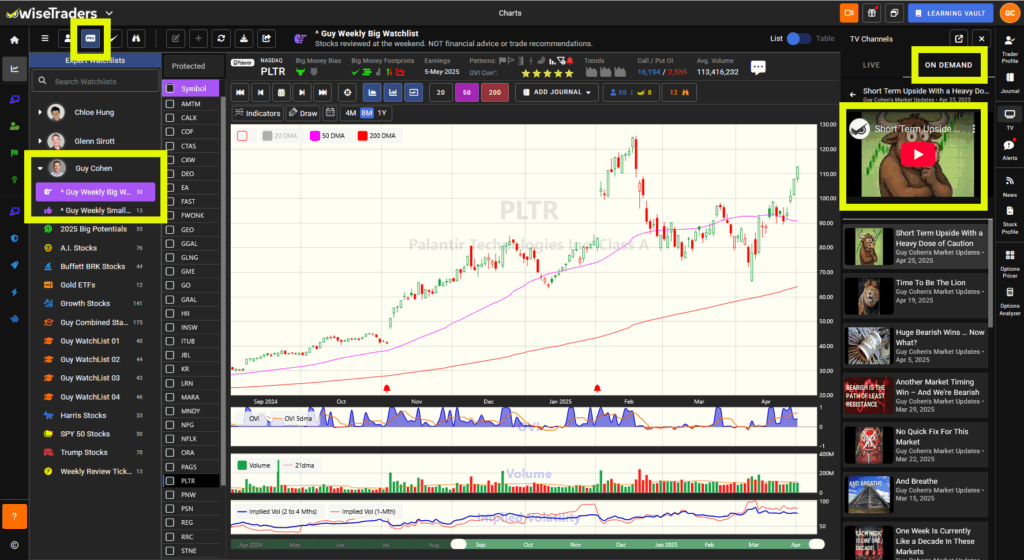

Watch today’s market review inside the members area here! To the left is the Watchlist area. To the right is the TV area.

How to Watch This Video:

The best way to watch this video so you can flip through the charts at the same time:

- Log into the members area: https://platform.wisetraders.com

- Click on TV within the Platform (top right)

- Choose “On Demand”

- Play

—

—

Remember, you can play the video at 1.25x or 1.5x speed if you want to save time! I have placed all the stocks covered in today’s review in your “Latest Preview” watch list.